Improving the quality of decision-making through a rigorous process.

Through the Indivisible Partners wealth planning and advice process, we evaluate decision-making against short- and long-term objectives. Our highly disciplined and replicable framework was built to guide advisors as they balance risk management with desired client outcomes. By offering this sophisticated yet accessible advice model, we enable collaborative decision-making that is consistent and adaptable to evolving client needs and goals and changing market conditions.

A holistic view brings clarity to the process.

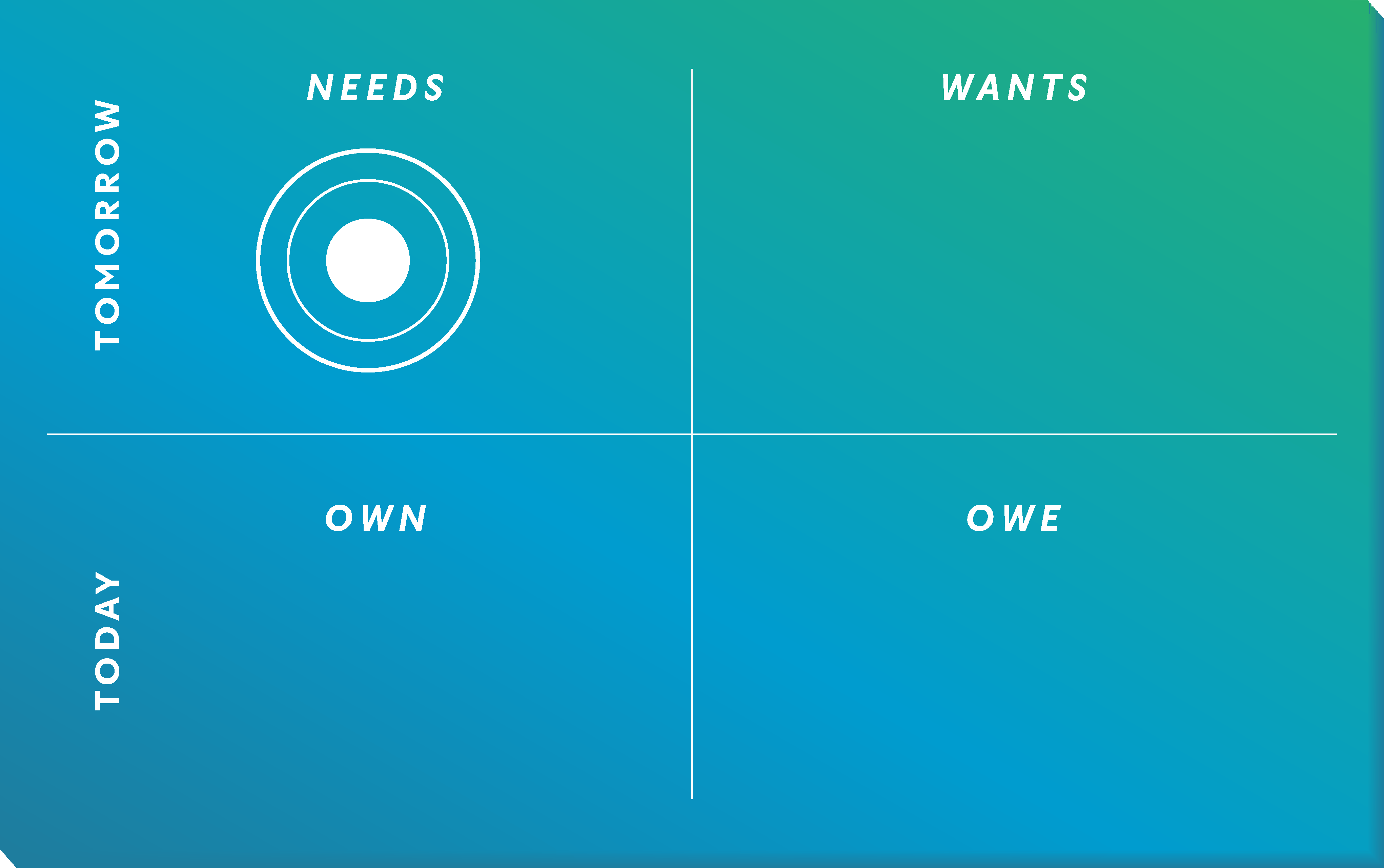

Creating a full financial picture for each client is the first step toward advice that enables quality decision-making. And while each client is unique, we base every financial picture on four key areas:

- Future savings and income (what you need)

- Goals (what you want)

- Assets (what you own)

- Liabilities (what you owe)

This comprehensive view allows clients to see how today’s resources and short-term cash-flow decisions may impact future goals and aspirations, ensuring that every decision made also considers any potential trade-off—because it is only by having a fully holistic financial picture and assessing comprehensive risk that we can provide impactful advice that will help clients achieve their desired outcomes.

Explore the difference

Find out how to become an Indivisible Advisor